Jennifer Aniston participará en la cuarta temporada de ‘Friends’ junto al actor del que se estaba separando

Medios relacionados – Noticias 24 horas Sabemos más sobre la vida privada de Jennifer Aniston de lo que a ella misma le hubiera gustado saber. Sabemos que estudiamos con Brad…

El peso de una conexión entre los frentes de guerra en Europa, Oriente Próximo y Asia-Pacífico

Medios relacionados – Últimas noticias Irán lanzó su respuesta al reciente ataque de Israel contra un consulado de la República Islámica en Siria el sábado por la noche. El episodio…

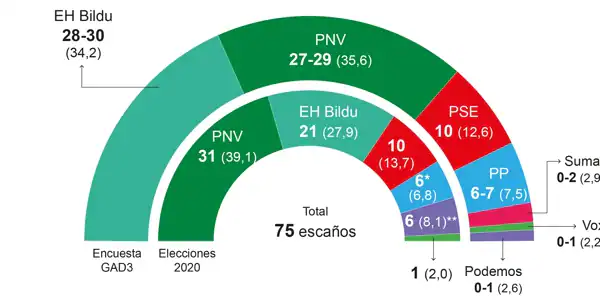

Bildu supera el mínimo en el PNV y los socialistas decidirán el traspaso

Medios relacionados – Noticias recientes Desde 1980, cuando se celebraron las primeras elecciones al Parlamento español, los dirigentes políticos de ETA serán los alcaldes más fuertes de esta cámara autonómica…

Figura 01, el robot busca al humanoide que la ciencia imaginó

Más noticias – Noticias 24 horas La figura 01 es el prototipo que más buscaba el humanoide que la ciencia había anticipado. El robot que dedicó este marzo al inversor…

Plan de organización para adecuar el crédito bancario a la evolución del ciclo típico y al desarrollo del crédito en las Pymes

Más noticias – Noticias de última hora El ministro de Economía, Comercio y Empresas, Carlos Cuerpo, ha mostrado un partidario de ajuste y adaptación de la carga a las entidades…

/cloudfront-eu-central-1.images.arcpublishing.com/prisa/MOXXTLJT2Z6VEUX4YEOA3F4B2A.jpg)

/cloudfront-eu-central-1.images.arcpublishing.com/prisa/LFO6NYKDYNGQJMNQRNDG6YRK7Q.jpg)